LUXUO examines China’s electric-vehicle market at a essential juncture, the place slowing home demand, fierce native competitors and impressive world growth are redefining the business. From BYD overtaking Tesla to the struggles of legacy automakers, the market is in flux — providing each challenges and alternatives for manufacturers and customers alike.

A Market at Its Inflection Level

China’s electric-vehicle (EV) story is now not considered one of regular progress. The sector is present process a strategic pivot because it offers with weakening home demand, diminished authorities incentives and elevated margin stress. China’s EV sector — as soon as a forerunner of unstoppable growth — is now going through a extra disputed actuality in 2026.

Earlier coverage frameworks positioned EVs on the centre of China’s industrial aspirations. That has modified: Beijing has omitted EVs from the most recent five-year plan’s checklist of precedence industries, signalling the tip of the interval of unfettered backing.

Bloomberg has highlighted rising investor issues, citing revenue points and disappointing outcomes amongst EV producers. In the meantime, exports have emerged as a key progress driver. Abroad shipments of Chinese language cars — which might be primarily electrified in 2025 — climbed at the same time as home gross sales slowed on the finish of the 12 months, forcing makers to hunt for demand elsewhere. Xpeng’s aggressive 2026 ambitions mirror deliberate adaptability reasonably than naive hope. Xpeng’s intention to promote as much as 600,000 autos displays a want to diversify merchandise and discover new applied sciences.

Nevertheless, not all tales are constructive. Commentators resembling The Atlantic have described the market as “imploding” in locations, citing important reductions and waning buyer enthusiasm.

BYD and the World EV Crown

China’s EV story will not be solely home; it’s world. In 2025, BYD eclipsed Tesla because the world’s largest vendor of EVs, a milestone that displays quantity progress, affordability and vertical integration. The Shenzhen-based producer has management over essential elements — significantly batteries — which permits it to handle prices and provide chain danger extra successfully than Tesla. BYD’s improvement into Europe, Latin America and Southeast Asia highlights how Chinese language EV manufacturers could leverage native scale to attain worldwide dominance. As Stella Li — BYD’s government vice chairman — factors out, the emphasis is “on merchandise individuals can really afford and use on daily basis.”

VW Slips to Third Place in China

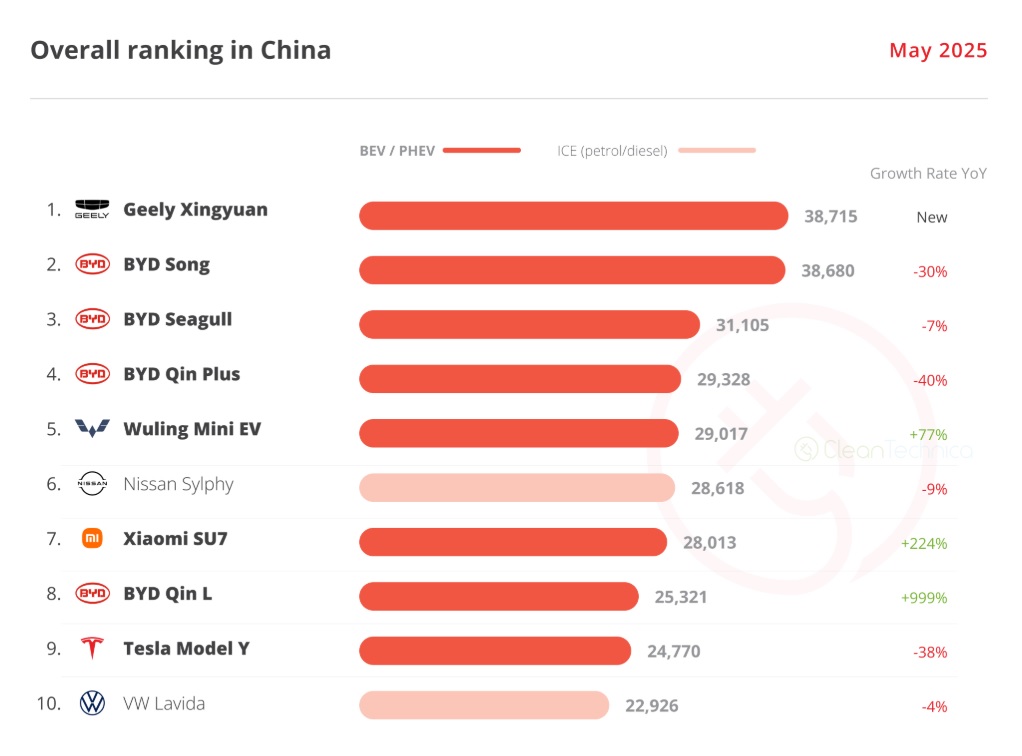

Volkswagen — China’s long-time market chief — fell to 3rd place in 2025, trailed solely behind BYD and Geely, with fourth-quarter gross sales down 17.4 %. VW and BYD each misplaced market share on account of heavy competitors from Chinese language rivals, notably within the funds sector. VW intends to launch China-specific EVs and develop exports, however regaining home market share stays a significant problem for CEO Oliver Blume.

Spaniard’s Love for BYD

Spain’s EV market is increasing, however Chinese language automaker BYD — not native manufacturers — is the first beneficiary. BYD’s market share topped 10 % in July 2025, outperforming Tesla — due to nearly 100 sellers and cheap EV and plug-in autos. Legacy European automakers — resembling Seat — are dropping place on this change.

Actually, 2024 was a tough 12 months for German automakers in China, with Porsche gross sales falling 28 % and Volkswagen, BMW, and Mercedes-Benz all dropping floor to native rivals. Weak home demand and lower-cost Chinese language rivals have pushed employment layoffs and capability reductions, indicating that the German auto business will proceed to face stress.

Tesla’s Stance

Tesla concedes elevated competitors as BYD overtakes world EV gross sales, threatening its market dominance in China, Europe and different key markets. In response, Tesla is modifying its value, increasing its automobile lineup and expediting the event of extra fashions, all whereas specializing in software program, autonomy and power integration as differentiators. To regain traction, CEO Elon Musk focuses on AI innovation, manufacturing effectivity and world manufacturing scale. As well as, the company is extending its overseas attain and contemplating strategic partnerships to defend its management in key sectors towards rapidly growing Chinese language rivals.

The Home Demand Problem

Probably the most fast stress level is a drop in home consumption. After a number of years of intensive authorities incentives (subsidies, tax breaks and shopping for help), these mechanisms are fading. In response to a latest South China Morning Put up analysis, sluggish year-end gross sales and competitors stress have restarted low cost wars, with huge manufacturers implementing steeper value cuts to clear inventories. Trade analysts additionally warn that many smaller EV producers are going through a “do-or-die” second. Eradicating subsidies and tax breaks threatens weaker companies, exposing the business’s pure shakeout.

That contraction is structural, reasonably than cyclical. Overcapacity, margin erosion and elevated competitors have shifted the equation for each current and rising companies. China’s provide system — beforehand praised for its breadth and sturdiness — isn’t any exception. Battery commoditisation and fluctuating uncooked materials costs have pushed margins down, at the same time as value battles unfold to element suppliers.

China’s Used-Automotive Rip-off

China’s “zero-mileage” used-car export program allows producers to register new autos as previous and promote them abroad, inflating home gross sales figures whereas sustaining manufacturing unit output regardless of falling native demand. The technique places stress on world rivals by flooding worldwide markets with low-cost autos, but it surely additionally poses reputational points — doubtlessly undermining Chinese language EV manufacturers overseas. Whereas it quickly boosts home income and reduces overcapacity, the gray market obscures the true well being of China’s EV enterprise, suspending business consolidation and concealing elementary points which will floor sooner or later years.

What This Means for Homeowners and Manufacturers

China’s current and future EV house owners face a combined however resilient image. Charging infrastructure and know-how developments proceed to develop and plenty of localities are loosening non-EV buying prohibitions to make sure accessibility. Regardless of diminished purchaser incentives, EV adoption is widespread — aided by low-cost fashions and rising familiarity. Broader business predictions nonetheless envision EVs buying a better share of whole automobile gross sales within the coming years, even when the tempo slows.

Charging infrastructure growth is a prime purpose as cities plan community densification to allow elevated EV use. China’s present and potential EV customers face a combined however resilient image. Charging infrastructure and know-how developments are persevering with to develop and plenty of communities are easing non-EV buy restrictions to permit accessibility. Regardless of decrease purchaser incentives, EV adoption is rising, supported by low-cost fashions and extra consciousness. Broader business estimates nonetheless present EVs gaining a bigger share of whole auto gross sales sooner or later, even when the speed slows. Charging infrastructure growth is a major precedence as cities plan community densification to help rising EV use.

Strategic Classes and Future Trajectory

China’s EV enterprise presently gives quite a few academic classes for governments and business leaders worldwide:

Authorities help is vital, but it surely should evolve: Authorities incentives initially drove EV gross sales, however eradicating them revealed that client demand will not be as sturdy as anticipated.

Aggressive depth hastens maturation: Value wars and overcapacity are indicators of maturity reasonably than weak spot. Solely financially prudent and innovation-driven gamers will survive.

Export diversification is important: Home saturation necessitates a worldwide presence. Exports are now not a supplementary technique, however reasonably a key income supply.

Lastly, China’s EV atmosphere is getting into a interval of consolidation and strategic recalibration. Progress will proceed, however on the expense of elevated business self-discipline and sharper aggressive distinction. The longer term for EV house owners stays shiny — with extra choices and improved infrastructure — whereas EV manufacturers’ sustainability more and more rests on worldwide competitiveness as a lot as home demand.

For extra motoring reads, click on right here.